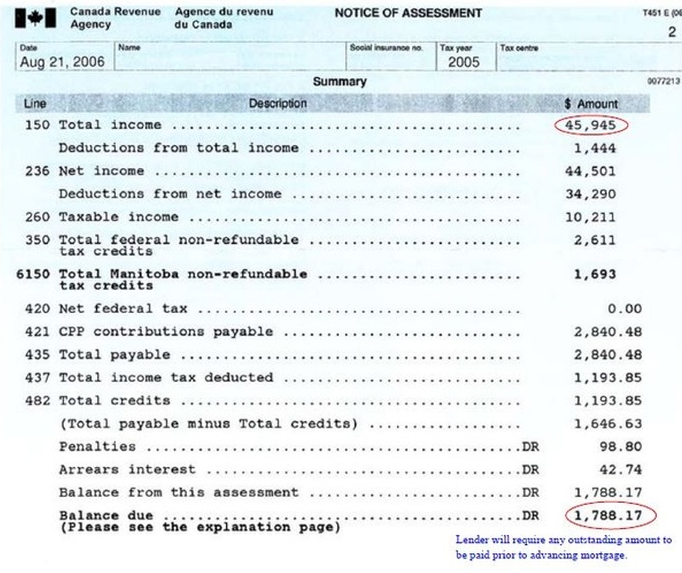

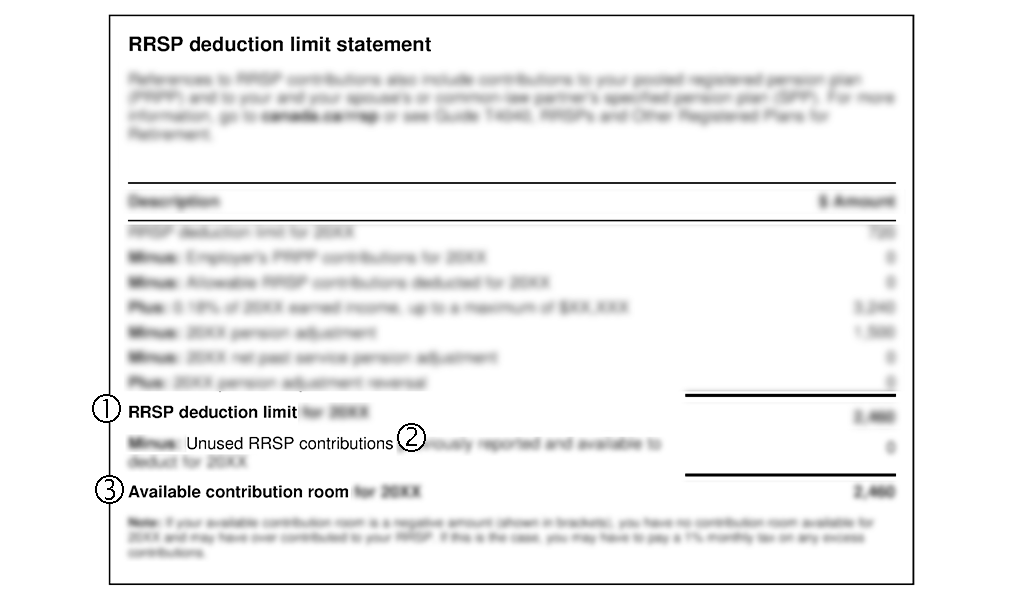

Apr 29, 2020. Line 15000 on your T1 tax return refers to your Total Income (gross) before you make any deductions (it used to be called line 150). To calculate the number on line 15000 on your tax return, all you have to do is add the amounts from lines 10100, 10400 to 14300, and line 14700. Keep in mind, this is not the income your taxes are.. 17.B: Enter described payments that were included in line 150 of your spouse's or common-law partner's Notice of Assessment, add them up and print the total. 17.C: Deduct the total entered at 17.B (line 6) from the amount at 17.A (line 1). The result 17.C is the total income your spouse or common-law partner can contribute as per this.

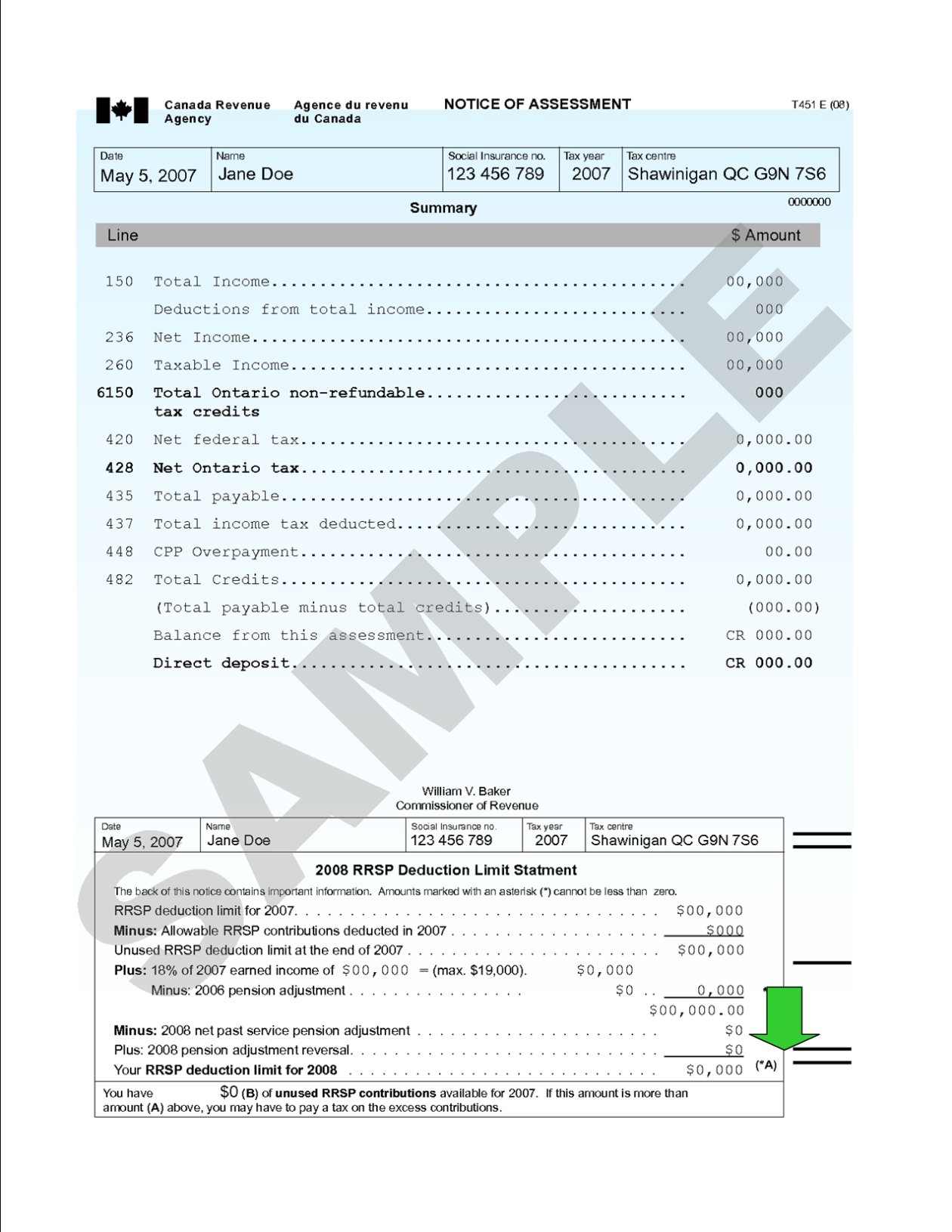

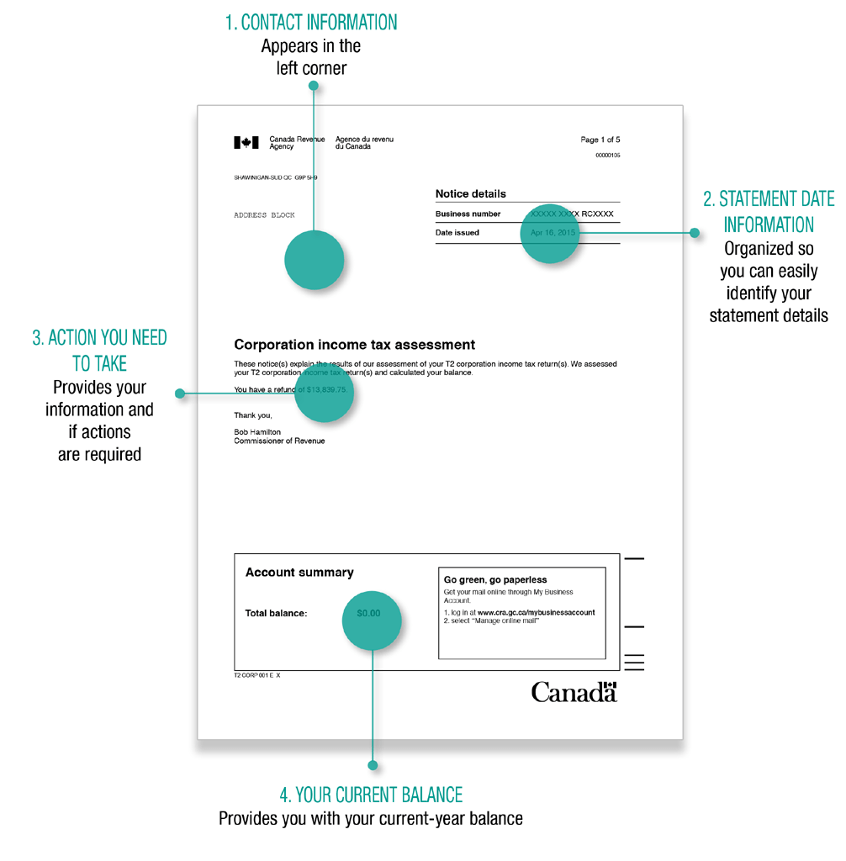

Example CRA Notice of Assessment Paper Copy The Woollam Mortgage Team

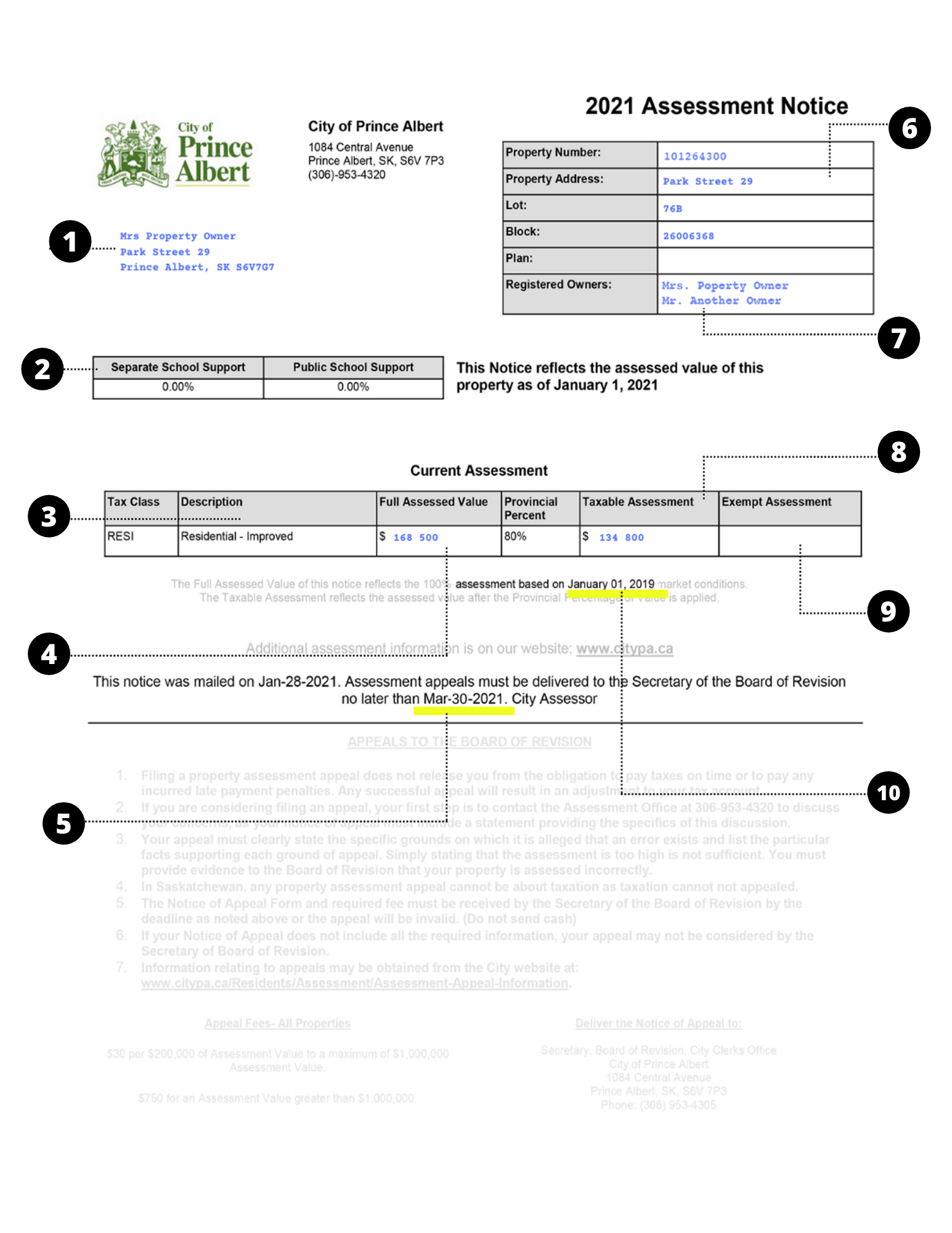

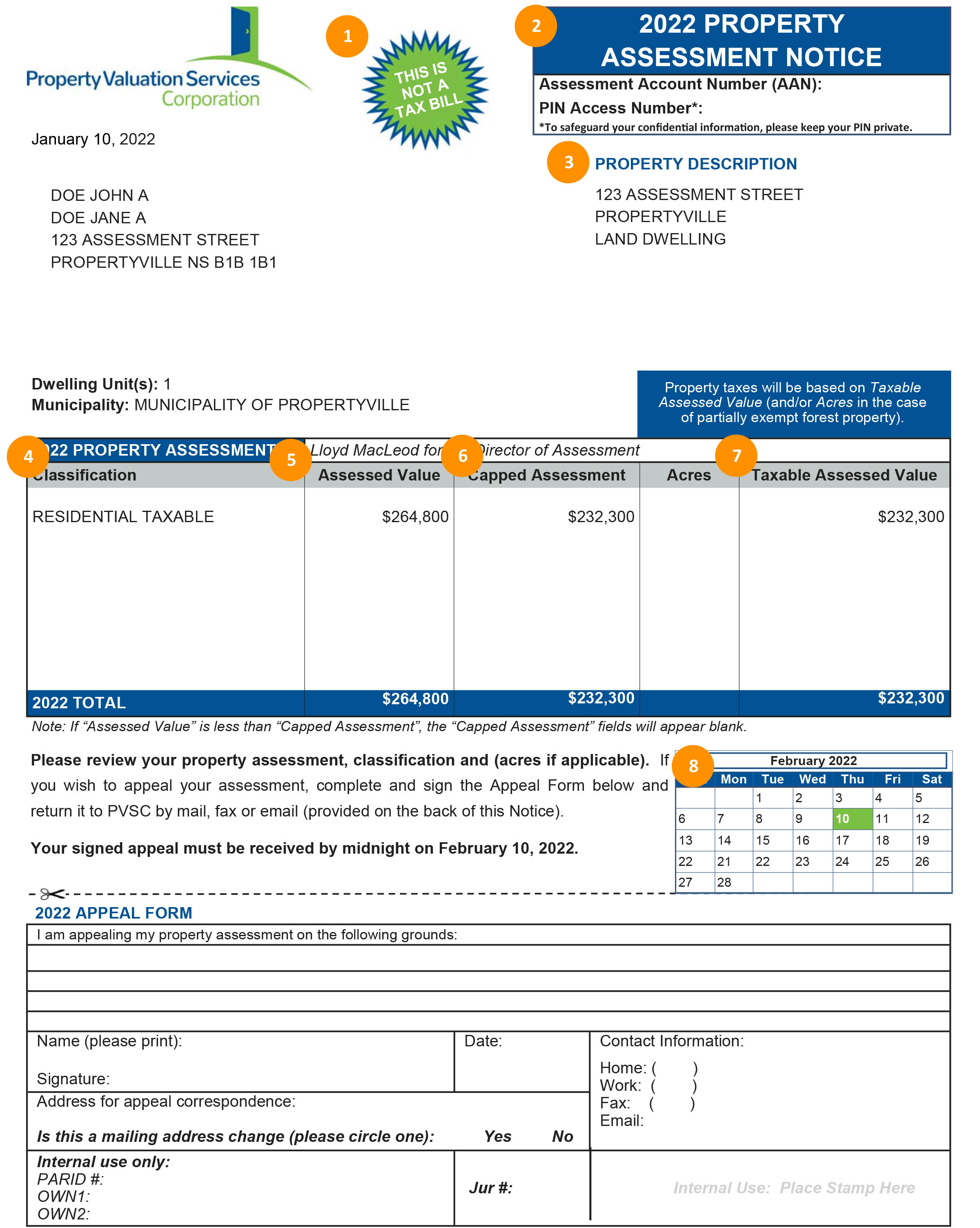

Understanding your Assessment Notice City of Prince Albert

Notice of Assessment Tax Form Federal Notice of Assessment in Canada 2022 TurboTax® Canada Tips

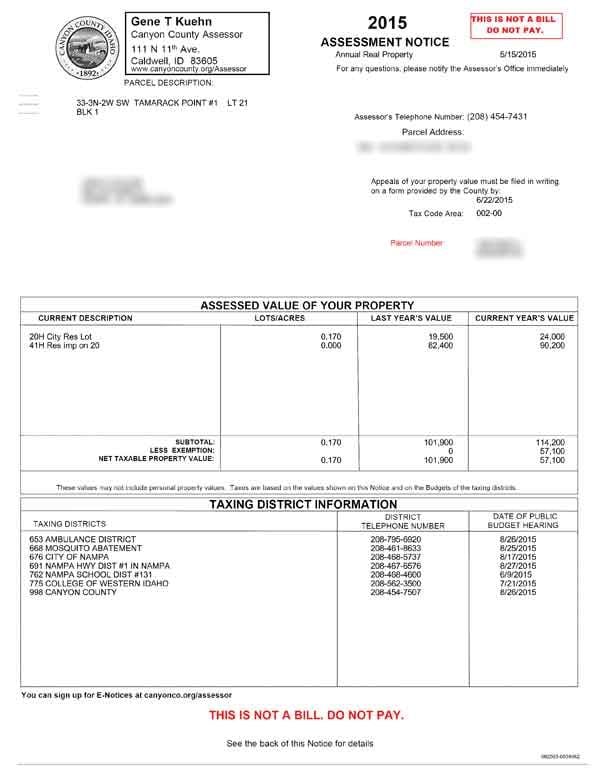

Assessment appeal Placer County, CA

Increase your clients' using gross ups and add backs Bridgewater Bank Brokers

Document upload guidelines

Notice of Assessment Tax Form Federal Notice of Assessment in Canada 2022 TurboTax® Canada

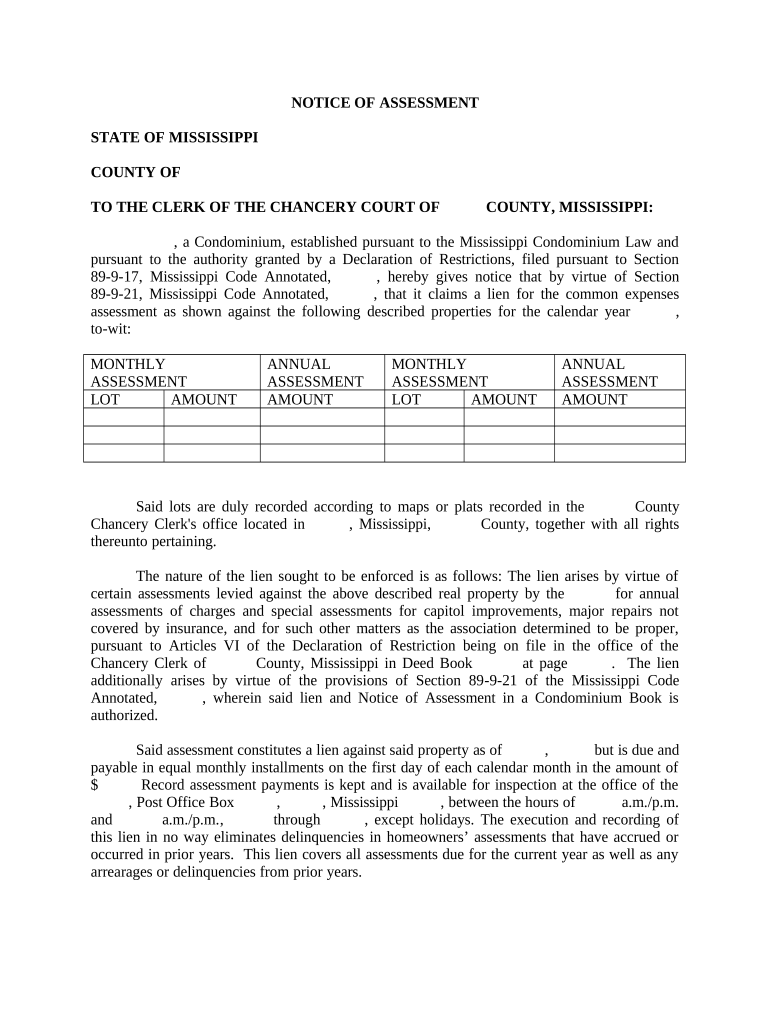

Notice Assessment Sample Form Fill Out and Sign Printable PDF Template SignNow

VeriDoc Global. VeriDoc Global Use Case Breakdown Notice Of Assessment

Notice of Assessment Overview, How To Get, CRA Audits

Your Property Assessment Notice Property Valuation Services Corporation

What is a Notice of Assessment (NOA) and T1 General? Filing Taxes

After sending us your tax return Learn about your taxes Canada.ca

What to know about your property assessment Members

How to download your Notice of Assessment in your CRA My Account? My Rate Compass

Articles Understanding the CRA Notice of Assessment Fund Library

Why is your Notice of Assessment important? YouTube

Notice of Assessment Mackenzie Gartside & Associates

Assessment Notices, Nez Perce County Assessor

NOTICE OF COMPLETION OF FINAL ASSESSMENT ROLL Minerva New York

an assessed return, notice of assessment or reassessment, other tax document or be signed in to My Account; If you are calling the CRA on behalf of someone else, you must be an authorized representative. Telephone number. 1-800-959-8281. Yukon, Northwest Territories and Nunavut: 1-866-426-1527. Outside Canada and United States (Eastern Standard.. Refund or balance owing. Your notice of assessment (NOA) is an evaluation of your tax return that the Canada Revenue Agency sends you every year after you file your tax return. Your NOA includes the date we processed your tax return, and the details about how much you may owe, or get as a refund or credit. The NOA also gives your Registered.